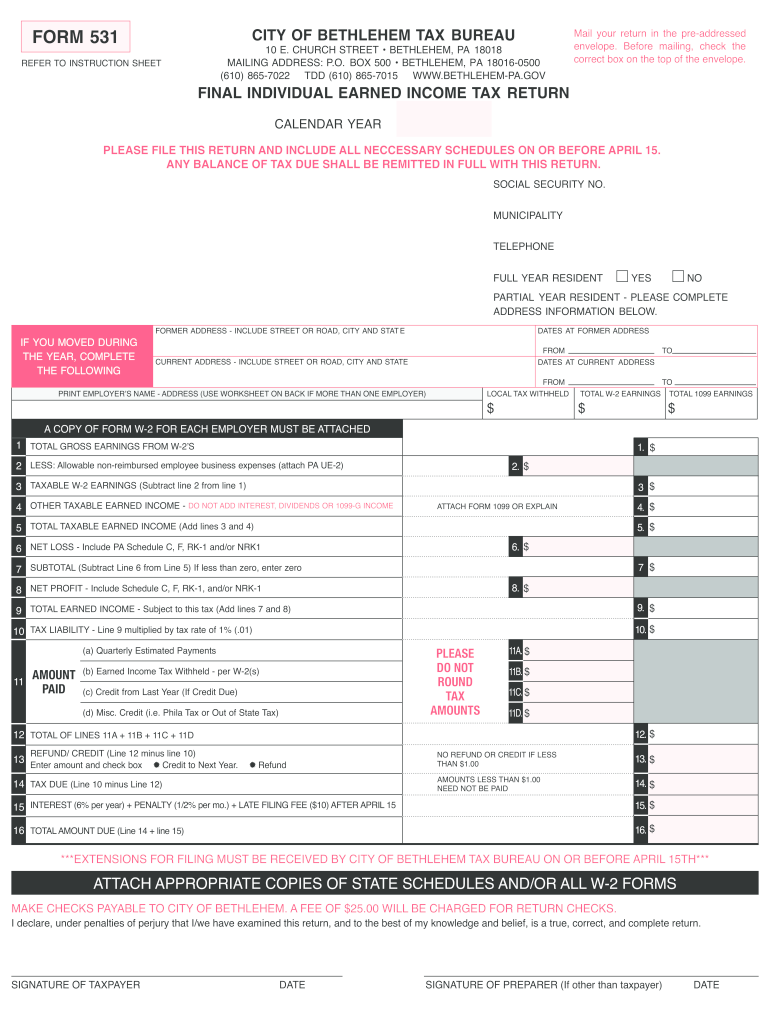

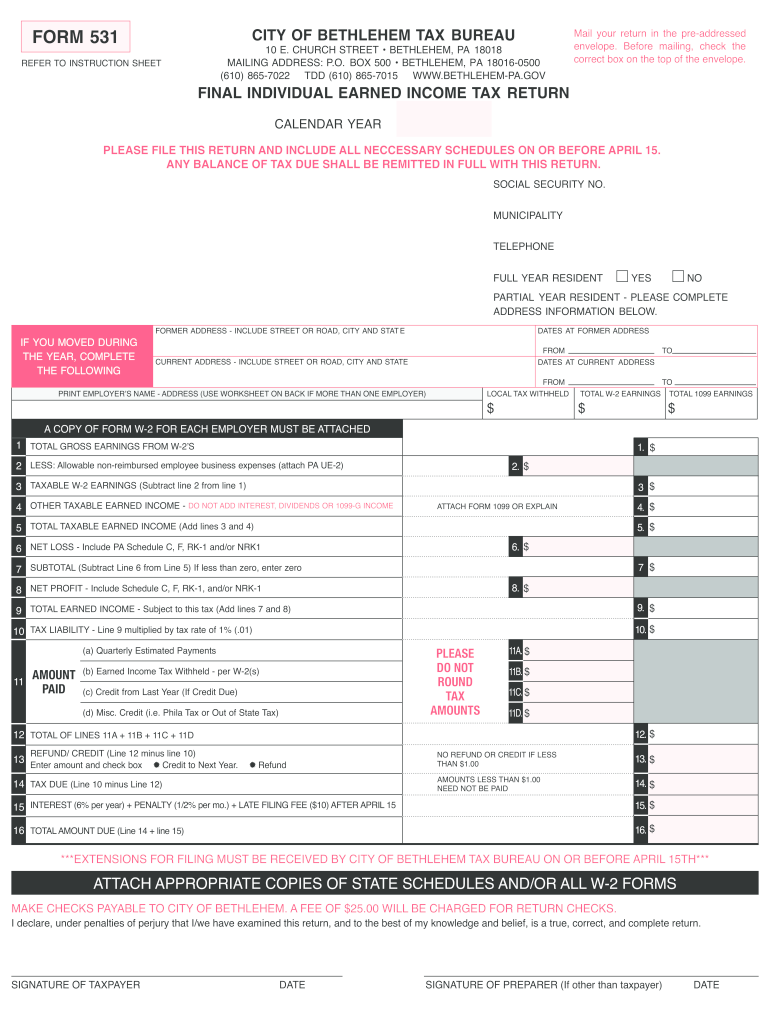

PA 531 - Bethlehem 2007-2026 free printable template

Show details

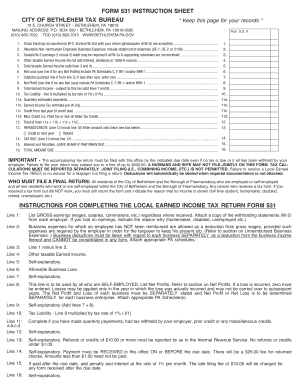

CITY OF BETHLEHEM TAX BUREAU FORM 531 REFER TO INSTRUCTION SHEET 10 E. CHURCH STREET BETHLEHEM PA 18018 MAILING ADDRESS P. O. BOX 500 BETHLEHEM PA 18016-0500 610 865-7022 TDD 610 865-7015 WWW*BETHLEHEM-PA. GOV Mail your return in the pre-addressed envelope. Before mailing check the correct box on the top of the envelope. FINAL INDIVIDUAL EARNED INCOME TAX RETURN CALENDAR YEAR PLEASE FILE THIS RETURN AND INCLUDE ALL NECCESSARY SCHEDULES ON OR BEFORE APRIL 15. ANY BALANCE OF TAX DUE SHALL BE...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pa form 531

Edit your city form 531 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cumberland county tax bureau form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form 531 online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit how to file local taxes in pa form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pa local tax form

How to fill out PA 531 - Bethlehem

01

Obtain a copy of the PA 531 form from the official Bethlehem website or local government office.

02

Read the instructions carefully to understand the purpose of the form.

03

Fill out your personal information at the top of the form, including your name, address, and contact information.

04

Provide any additional required information specific to the nature of the form depending on the context.

05

Double-check the form for accuracy and completeness before submitting.

06

Sign and date the form where indicated.

07

Submit the completed form according to the instructions, whether by mail, in person, or electronically.

Who needs PA 531 - Bethlehem?

01

Individuals or businesses applying for specific permits or licenses in Bethlehem.

02

Residents needing to report information or submit applications related to local governance.

03

Anyone required to provide documentation for tax purposes in Bethlehem.

Fill

pa 1099 form

: Try Risk Free

People Also Ask about pa 531

What address should I put when filing taxes?

What should I do if the address on my W-2 is different than the mailing address on my tax return? Use the address shown on your W-2 for entering your W-2 information. It doesn't matter if it's different than the mailing address you will use on your tax return.

How do I find my address for the IRS?

2:12 4:18 How to Verify the IRS Has My Correct Address? - YouTube YouTube Start of suggested clip End of suggested clip So the irs is an online tool a get transcript. Tool here's the the website. And what you could do isMoreSo the irs is an online tool a get transcript. Tool here's the the website. And what you could do is an individual taxpayers you go there you request a transcript of your most recently filed.

What address should I use for taxes?

Filing Address: Also knows as the legal address, this is your primary place of business and it should match the address you have on file with the IRS as the company's physical location. This address is used when sending returns to taxing agencies.

How do I send mail to IRS?

Use certified mail, return receipt requested, if you send your return by U.S. mail. It will provide proof that it was received. The IRS accepts deliveries from FedEx, UPS, and DHL Express. But you must use an approved class of service.

Does the address matter when filing taxes?

If you file your return with the wrong address, that can't really be undone. You'll need to contact the IRS directly to update your address (you can use their toll-free number: 1-800-829-1040). If your return(s) are rejected by the IRS, you can simply change your address before resending your tax return.

How do I send a letter to the IRS?

Make a copy of the notice you received from the IRS and include it with your letter. In the first paragraph of your letter, explain why you are writing the IRS.Format your letter. The IRS address (see your IRS notice) Your name and address. The date. A salutation, such as “To Whom It May Concern”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify PA 531 - Bethlehem without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including PA 531 - Bethlehem, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in PA 531 - Bethlehem?

The editing procedure is simple with pdfFiller. Open your PA 531 - Bethlehem in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I edit PA 531 - Bethlehem in Chrome?

PA 531 - Bethlehem can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

What is PA 531 - Bethlehem?

PA 531 - Bethlehem is a local tax form that residents of Bethlehem, Pennsylvania are required to file in order to report their local earned income and municipal services tax.

Who is required to file PA 531 - Bethlehem?

Residents of Bethlehem who earn income, as well as non-residents who work in Bethlehem, are required to file PA 531 - Bethlehem.

How to fill out PA 531 - Bethlehem?

To fill out PA 531 - Bethlehem, you must provide personal information, report your total earned income, calculate the appropriate local tax, and provide relevant additional details as per the instructions on the form.

What is the purpose of PA 531 - Bethlehem?

The purpose of PA 531 - Bethlehem is to collect local earned income and municipal services taxes, ensuring that the city receives funds necessary for local services and infrastructure.

What information must be reported on PA 531 - Bethlehem?

PA 531 - Bethlehem requires reporting of personal details such as name, address, and social security number, along with total earned income, deductions, and any local tax owed.

Fill out your PA 531 - Bethlehem online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA 531 - Bethlehem is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.